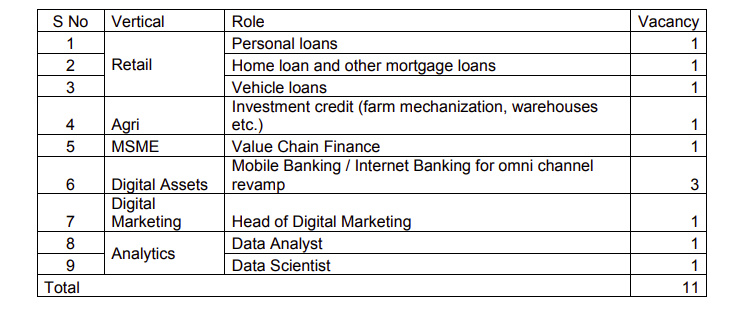

INDIAN BANK, a leading Public Sector Bank, with headquarters in Chennai having

geographical presence all over India and abroad invites applications from Indian

Citizens for engagement as Product Owner on contractual basis.

Age Minimum Age – 30 years and Maximum Age 50 years as on 01.07.2022 (for

all post)

Place of work Chennai or as decided by the Bank.

Selection procedure:-

The applications received from the candidates will be screened and

shortlisted on the basis of eligibility and relevant experience.

- The requisite number of shortlisted candidates will be called for

interview for final selection. If more number of Applications received

a preliminary scrutiny process (Group Discussion, Interview etc.) may

be conducted. - The final selection will be made on the basis of eligibility, experience,

qualification and performance during interaction / interview. - The interaction / interview will be conducted by a committee

constituted for the purpose. - Mere satisfying the eligibility norms do not entitle a candidate to be

called for interview. - The Bank reserves the right to reject any application not suiting the

Bank’s requirements without assigning any reason whatsoever and

call only the requisite number of candidates out of those who fulfill

the eligibility criteria as may be required for the post.

Application Fees Rs 1000/-

Product Owner: Personal Loans

Educational

Qualification Masters or equivalent in management, Bachelors or equivalent

in IT, technology fields

Product Management certifications desirable

Mandatory

Experience 5+ years of product management experience in PSBs, private

sector banks or NBFCs

Experience in personal loans, pension loans, loans to selfemployed individuals

Desired Skills

Collaborate with multiple stakeholders across departments

like on-ground branch teams, collections, digital teams

Communicate effectively with developer talents and vendors

Ability to prioritize tasks basis business understanding

Strong analytical skills, comfortable reviewing and analyzing

business performance metrics, ability to pivot based on data

insights

Strong knowledge of product management tools and best

practices – workflow management tools like JIRA, Asana or

Slack, Root cause analysis, retrospectives, etc.

Understanding of MS Excel, Access, Word and PowerPoint

Understanding of risk management

Home loan and other mortgage loans

Educational

Qualification Masters or equivalent in management, Bachelors or equivalent

in IT, technology fields

Product Management certifications desirable

Mandatory

Experience 5+ years of product management experience in PSBs, private

sector banks or NBFCs

Experience in home loans / assets

Desired Skills

Collaborate with multiple stakeholders across departments like

on-ground branch teams, collections, digital teams

Communicate effectively with developer talents and vendors

Ability to prioritize tasks basis business understanding

Strong analytical skills, comfortable reviewing and analyzing

business performance metrics, ability to pivot based on data

insights

Strong knowledge of product management tools and best

practices -workflow management tools like JIRA, Asana or

Slack, Root cause analysis, retrospectives, etc.

Understanding of MS Excel, Access, Word and PowerPoint

Understanding of risk management

Product Owner: Vehicle loans

Educational

Qualification Masters or equivalent in management, Bachelors or equivalent

in IT, technology fields

Product Management certifications desirable

Mandatory

Experience

5+ years of product management experience in PSBs, private

sector banks or NBFCs

Experience in secured retail loans / assets with hypothecation

Desired Skills Collaborate with multiple stakeholders across departments like

on-ground branch teams, collections, digital teams

Communicate effectively with developer talents and vendors

Ability to prioritize tasks basis business understanding

Strong analytical skills, comfortable reviewing and analyzing

business performance metrics, ability to pivot based on data

insights

Strong knowledge of product management tools and best

practices – workflow management tools like JIRA, Asana or

Slack, Root cause analysis, retrospectives, etc.

Understanding of MS Excel, Access, Word and PowerPoint

Understanding of risk management

Product Owner: Investment credit (farm mechanization, warehouses etc.)

Educational

Qualification Mandatory qualification of either graduate in Agriculture or

related sciences or postgraduate in Agri Business Management

or similar fields

Optional qualification of Masters or equivalent in management,

Bachelors or equivalent in IT, technology fields, Product

Management certifications

Mandatory

Experience 5+ years of product management experience in PSBs, private

sector banks or NBFCs

Experience in Agri loans / assets in agri investment credit and

agri infrastructure

Desired Skills

Collaborate with multiple stakeholders across departments like

on-ground branch teams, collections, digital teams

Communicate effectively with developer talents and vendors

Ability to prioritize tasks basis business understanding

Strong analytical skills, comfortable reviewing and analyzing

business performance metrics, ability to pivot based on data

insights

Strong knowledge of product management tools and best

practices -workflow management tools like JIRA, Asana or

Slack, Root cause analysis, retrospectives, etc.

Understanding of MS Excel, Access, Word and PowerPoint

Understanding of risk management

Product Owner: Value Chain Finance

Educational

Qualification

Masters or equivalent in management, Bachelors or equivalent

in IT, technology fields

Product Management certifications desirable

Mandatory

Experience

5+ years of product management experience in PSBs, private

sector banks or NBFCs

Desired Skills Collaborate with multiple stakeholders across departments like

on-ground branch teams, collections, digital teams

Ability to communicate effectively with developer talents and

vendors

Significant expertise in financial services, banking sector

Ability to prioritize tasks basis business understanding

Strong analytical skills, comfortable reviewing and analyzing

business performance metrics, KPIs, ability to pivot based on

data insights

Strong knowledge of product management tools and best

practices – workflow management tools like JIRA, Asana or

Slack, Root cause analysis, retrospectives, etc.

Understanding of MS Excel, Access, Word and PowerPoint

Understanding of risk management

Product Owner: Mobile banking / internet banking for omnichannel revamp

Educational

Qualification

Masters or equivalent in management, Bachelors or

equivalent in IT, technology fields

Product Management certifications desirable

Mandatory

Experience

5+ years of product management experience in PSBs,

private sector banks or NBFCs

Experience of working on transaction banking on

digital channels

Experience of mobile/ internet/ tab/ Whatsapp banking,

payments, personal finance management, digital

customer experience

Desired Skills Collaborate with multiple stakeholders across departments like

on-ground branch teams, collections, digital teams

Communicate effectively with developer talents and vendors

Significant expertise in financial services, banking sector

Ability to prioritize tasks basis business understanding

Strong analytical skills, comfortable reviewing and analyzing

business performance metrics, KPIs, ability to pivot based on

data insights

Strong knowledge of product management tools and best

practices – workflow management tools like JIRA, Asana or

Slack, Root cause analysis, retrospectives, etc.

Understanding of MS Excel, Access, Word and PowerPoint

Product Owner: Head of Digital Marketing

Educational

Qualification

Masters degree or equivalent in Management, Marketing, IT,

Media, technology fields

Mandatory

Experience

15+ of marketing experience (with 10+ years of digital

marketing experience)

7+ years of team management experience

Knowledge of digital marketing tools available in the market

Desired Skills Timely execution of digital marketing campaigns

Adoption of digital marketing campaigns across Bank

products

Bank’s presence and reach across Social Media

Optimize cost per lead/ RoI of digital marketing campaigns

Internal peer feedback

Product Owner: Data Analyst

Educational

Qualification

Bachelor’s degree in Computer/System Science,

Mathematics, Econometrics, Statistics, Data Analytics or

other engineering field

Mandatory Experience

2+ years of experience working with data analytics and

visualization

Core Experience in the following tools – Data tooling, Tableau

10, Alteryx, additional – QlikSense, QlikView, R, Python, SAS,

SQL, R Shiny

Experience in Digital/Web Analytics, customer segment

analytics, personalization, portfolio analysis, cross-sell

analytics, risk analytics, financial analytics, funnel analysis

etc.

Working knowledge of Hadoop, SQL, Oracle

Desired Skills Collaborate with business / owner departments for use cases

Ability to communicate effectively with advanced analytics

talents, HR, other stakeholders

Banking industry understanding (Finance / FinTech

Experience)

Strong analytical (numeric and logical) skills

Ability to analyse problems, apply quantitative analytical

approaches

Product Owner: Data Scientist

Educational

Qualification

Bachelor’s degree in Computer/System Science, Mathematics,

Econometrics, Statistics, Data Analytics or other engineering

field

Mandatory Experience

2+ years of experience in advanced analytics, data science

Experience in core analytic methods such as predictive

modeling, customer segmentation/clustering, fraud detection

analysis, Artificial Neural Network (Deep Learning), SVM,

Random Forest etc.

Exposure to risk evaluation, credit risk modeling

Experience with software tools and technologies (e.g.

Python, R,

Tensorflow, Scikit, SAS, C/C++, Perl, Spark, PySpark, Scala)

Working knowledge of Hadoop, SQL, Oracle

Good applied statistics skills, such as distributions, statistical

testing, regression, Google analytics, Machine learning,

predictive analytics etc.

Desired Skills Collaborate with business / owner departments for use cases

Ability to communicate effectively with Advanced Analytics

talents, HR, other stakeholders

Procedure for applying:-

- Application complete in all respects as per the prescribed format (Annexure A) along

with copies of all the credentials as enumerated in Clause 2 below should be sent in a

closed envelope super scribed “Application for Engagement as Product Owner on

Contract Basis” to the following address:

General Manager (CDO), Indian Bank

Corporate Office, HRM Department, Recruitment Section

254-260, Avvai Shanmugham Salai, Royapettah, Chennai, Tamil Nadu – 600 014

All eligible and interested candidates should apply in the prescribed application format

to reach the address cited above on or before 03.09.2022

Indian Bank Recruitment 2022 Click here

Indian Bank Recruitment 2022 Career page click here

Application format for engagement of Product Owner – Retail, Agri, MSME & Digital Assets

Application format for engagement of Product Owner – Digital Marketing

Application format for engagement of Product Owner – Analytics